Core Differentiators

Experience the DXD Difference

DXD was built with the shared vision of being the most trusted and forward-thinking investment platform in the self storage industry.

DXD is built around the synergy created by assembling a best-in-class group of professionals with a shared vision and mission.

Company culture drives the success of DXD. Our dedication to our core values creates an environment of constant improvement, hyper-focused on delivering the best outcomes and highest returns to our investors.

Together the team has developed over 200 ground-up storage projects and has 100+ years of combined experience across 20+ states.

Since its inception in 2020, DXD has successfully raised over $230 million, funds that have been exclusively invested in the self storage real estate sector.

This singular focus enables us to achieve economies of scale and gain insights that are unparalleled in the self storage industry.

To date, DXD has launched two real estate funds: a fully discretionary fund and a GP fund, both strategically focused on seizing high-quality opportunities.

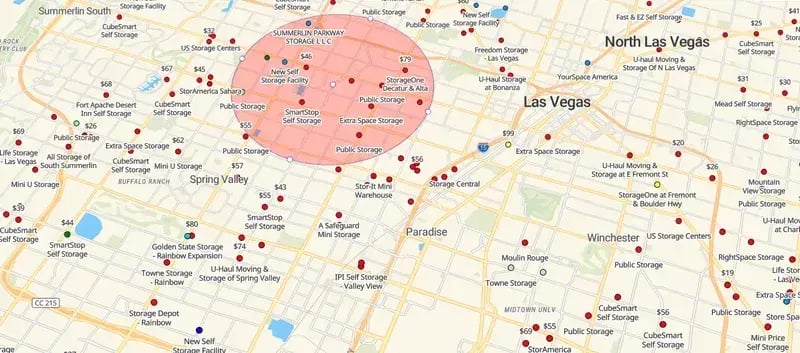

DXD Capital is in an unparalleled position to capitalize on the self storage sector because of its continuous innovation of analyzing unique data sets and dedication to constant improvement on how we analyze investment opportunities.

DXD has built proprietary tools and the industry’s best team to create efficiency and scale that is unmatched in the industry. This allows DXD to uncover the best investments and provides us with a structural advantage to deliver superior investor returns.

We have a data first mindset, creating an efficiency whereby we remain hyper focused on only the best investments.

Self Storage Investment Opportunities

DXD utilizes data to evaluate self storage development and acquisition opportunities across the United States, searching for the highest demand/supply imbalances in markets that have high barriers to entry.

Litchfield

Sahara

Flamingo

Atlanta Metro

Grand Teton

Jersey Shore

West Palm Beach

Bristol

Atlantic City

Kapolei

Daytona

Huntington Station

North Doral

Phoenix Metro

Kihei

Albuquerque

Nantucket

Alamo Ranch

Scottsdale

Georgetown

Richmond

Sarasota

Knoxville

Investor Education & News

LOAD MORE

Would you like to learn more?

Our Investors

"I have discovered a class act of really smart people, who know how to deliver on the operational day-to-day execution, making deals come to life. That's why I choose to invest in DXD"

Tim Handren

/

Investor

Our Investors

"If you are looking to invest in something that is low risk, with some really good people, who deploy a great strategy - I would strongly suggest looking into investing in self storage with DXD"

Ken Barbe

/

Investor

Our Investors

"DXD Capital is working to find the sweet spot in commercial real estate development, using their team and technology to identify self storage opportunities in the best locations possible, that seem to thrive in adverse times. I am very optimistic they will continue to run a successful program"

Doug Brown

/

Investor

Our Investors

"I have nothing negative to say and I am very confident these investments will come to fruition. If you are interested in exploring self storage investments, I highly recommend you connect with DXD"

Lori Woodcock

/

Investor

Our Investors

"I invest with DXD Capital because I know they are utilize cutting edge data technology to find the best self storage opportunities and the most current information"

Mandy Warr

/

Investor